There is a lot of talk (and confusion) about what is happening with the economy right now. After just a few weeks in office we’ve seen Trump implement new blanket tariffs, a hard crackdown on illegal immigration, Elon and DOGE cutting government programs and even historic federal layoffs. While CNN assures you that this administration is causing economic chaos with no plan whatsoever, I would like to present you with another possibility. Let’s dive in…

I would like to present you with the theory that this administration is orchestrating, on purpose, an economic slowdown. I wrote that this was a very real possibility in my 2025 Macro Outlook, and after just ~45 days it looks like they are truly going for it:

Tariffs + Economic Uncertainty

Restricted Immigration + Deportations

Cutting Government Spending + Mass Layoffs

The result of these actions should not be a surprise… they are not stimulative.

I wrote the above tweet in early February and since then, we have gotten several important statements and data supporting this theory. Every modern President and politician has been happy to allow illegal immigration and continue running up the deficit because it helps ensure headline growth under their term. Politicians only call for cutting spending when the other party is in power. Spending cuts and reduced immigration risks slowing growth and weakening the labor market, which would hurt you politically. However, Trump 2.0 seems to be ok with doing exactly that.

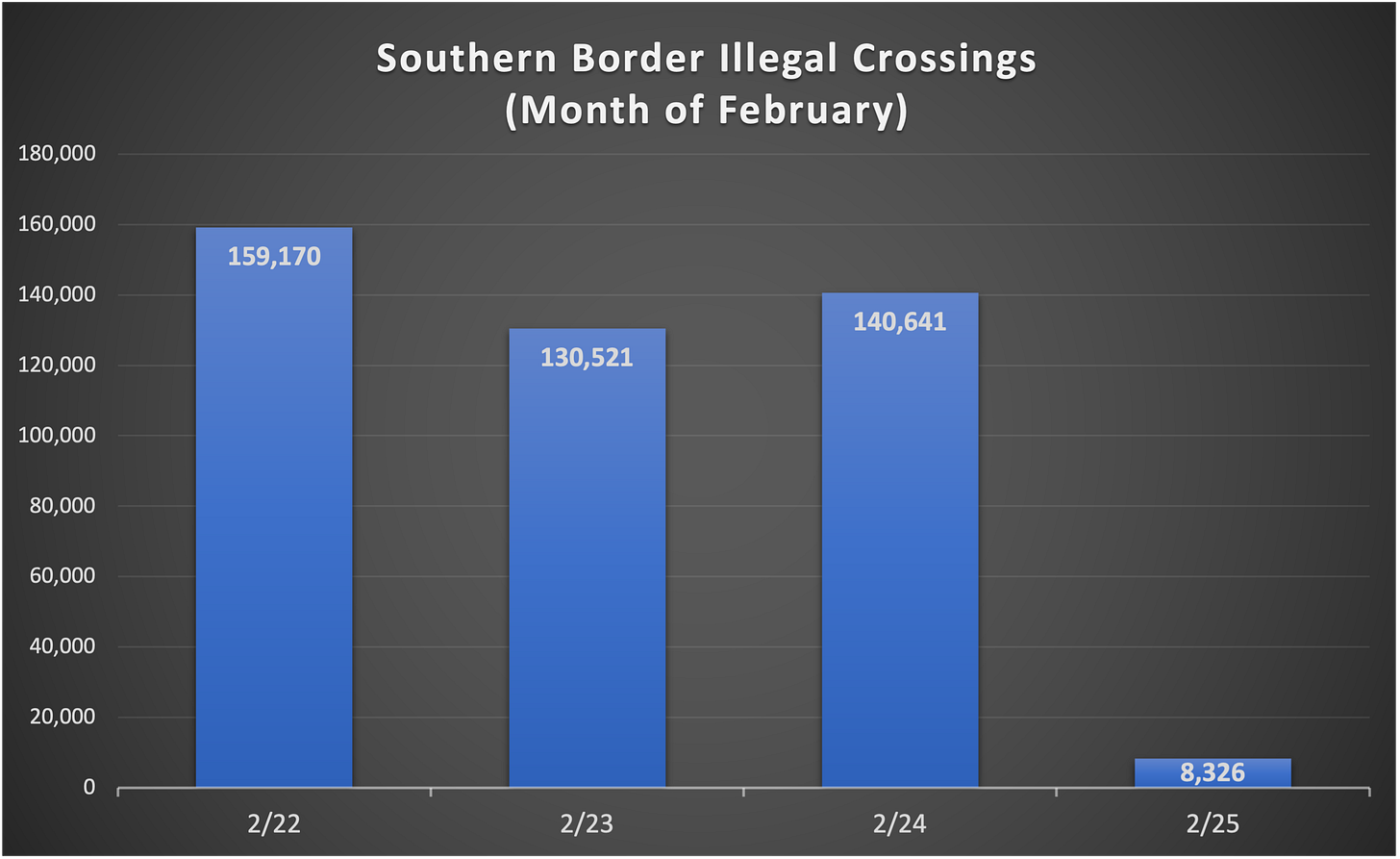

Looking at illegal immigration, it has virtually stopped overnight.

That poses real risks to a labor market which has become accustomed to new, cheap, illegal labor for many years now. On the tariffs and spending fronts, we have heard multiple statements recently confirming this theory from Treasury Secretary Scott Bessent, Commerce Secretary Howard Lutnick and even President Trump himself.

Bessent has made several comments about “re-privatizing” the US economy and how the Biden administration propped up GDP data with excessive government spending. He also said that they are focused on the “medium-term” and that the “Trump economy begins in 6-12 months”.

Well… if they have a year or so before taking responsibility for the economy and markets, what happens in the meantime? Here’s Howard Lutnick with the answer:

Now you may be thinking, “Lutnick and Bessent can say whatever they want, but what does Trump have to say? He would NEVER let the economy weaken or stock market drop with his name attached to it!” Not so fast…

Trump even decided to mention in his State of the Union address to the entire country that there would be “an adjustment period” with his new policies and to “bear with him”. Trump 1.0 bailed on most of his wild ideas pretty quickly as he was much more focused on ensuring the economy was growing and stocks were climbing. It’s very clear that at least so far, Trump 2.0 is different. Could it be that this is his last term? Has he changed after almost being assassinated? Sure, it could be. Or… it could be the man he has alongside him who is not afraid to take massive risks or upset the status quo… (No, not David Sacks)

Elon Musk.

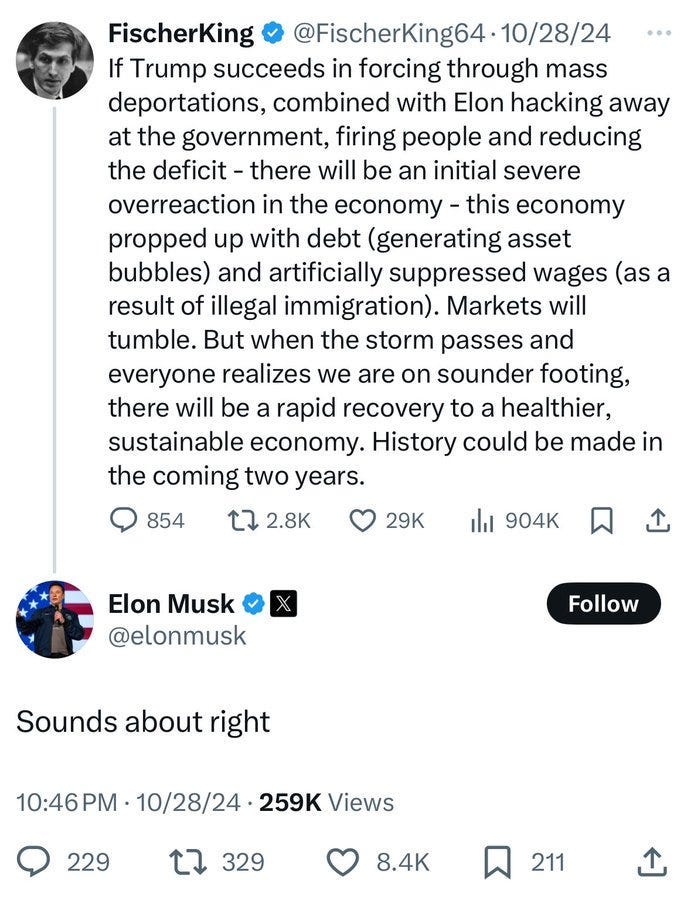

Please see the below tweet from Elon just BEFORE the election. He laid out and confirmed exactly what they are doing now. It’s not random chaos. It’s their plan.

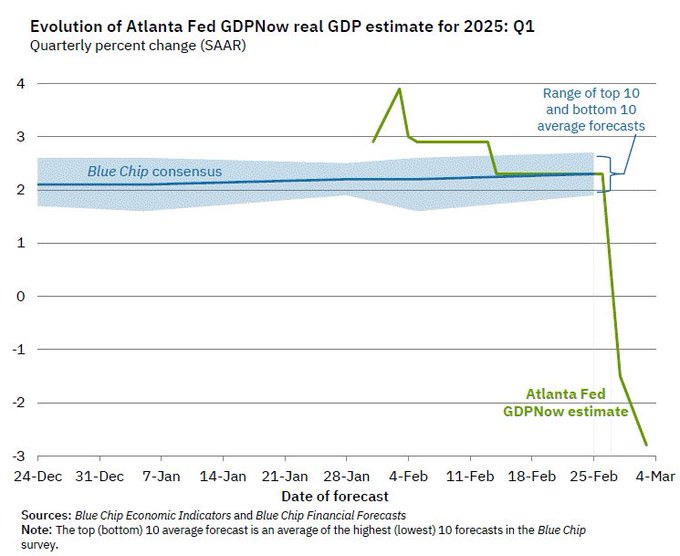

Their plan seems to be working already as the Atlanta Fed's Q1 GDP projection has absolutely collapsed. They are now projecting a large contraction of -2.8%. Last week it was -1.5% and just 4 weeks ago it was +3.9%. Some of it has to do with imports/exports and tariffs, but consumer spending has also dropped significantly.

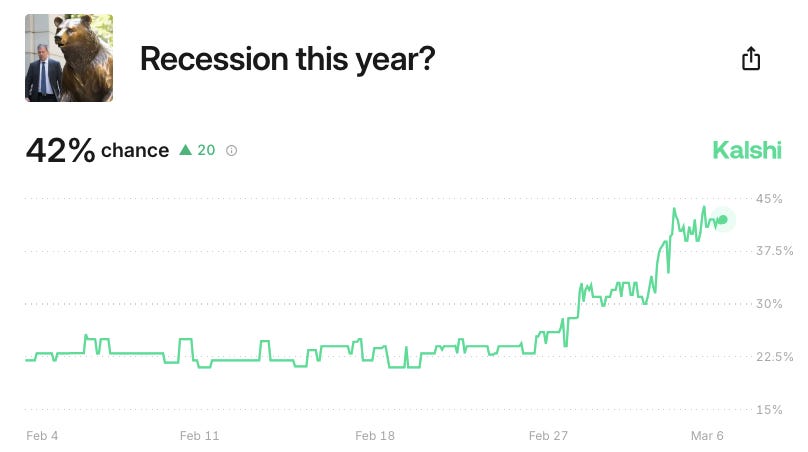

Plus, on markets like Kalshi the odds of a recession this year have spiked to 42%.

So now that this theory of a self-induced economic slowdown has some proof, the important question is, why? Why would Trump want to do this and risk his own popularity? Why not just allow more illegal immigration to support the labor market and ignore our historic deficits while taking credit for a juiced up, “booming” economy like every other politician would? Well, I have a few possible reasons:

First, as I mentioned in my 2025 Macro Outlook, a real growth slowdown or even a recession would all but guarantee that the Fed cuts rates meaningfully. So their plan could be trading a short-term slowdown in exchange for a significant drop in interest rates and more stimulative monetary policy towards the back half of 2025 and into 2026. It would be one hell of a way to follow through on his promise of lowering rates.

Second, this could tie in well with their political goals and timing. If they can get interest rates and mortgage rates down before the 2026 midterms, while boosting real estate and stocks after a slight downturn, it could be very beneficial. It will look like Trump kept his word telling everyone to trust him through a rough patch, and they successfully came out on the other side.

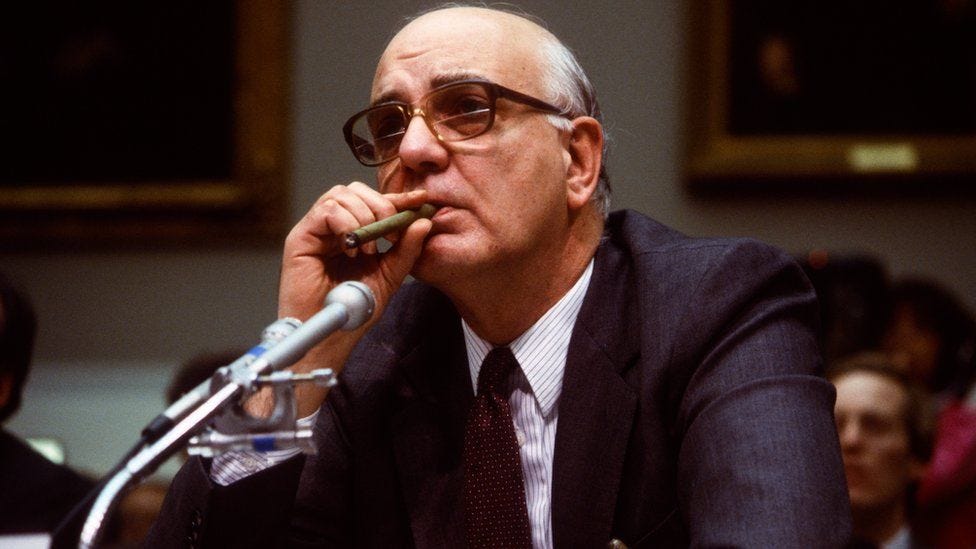

Third, following Paul Volcker’s playbook (RIP to a legitimate American hero), causing a purposeful slowdown or even recession to fully eliminate inflation could be just another benefit for Trump. A growth slowdown might be what is ultimately needed to ensure that inflation has receded and won’t pick back up. If Trump had started off his 2nd term going full “stimulus mode”, a 2nd inflation wave could have been a real threat.

Now… while this plan may make sense on paper, it’s a real political and economic risk.

There is a reason no politician ever purposefully creates a slowdown or even attempts to cut spending in any meaningful way while they are in power. They want to be popular. They would rather have short-term success while they are in office, and kick the can of possible problems down the road to the next guy. Trump 2.0’s strategy of “short-term pain, long-term gain” is unprecedented and dangerous (Trump 1.0 was happy to spend and kick the can). We simply have not seen this since Paul Volcker and Ronald Reagan.

A quick historical reminder:

Ronald Reagan was elected in a Republican “landslide” after a very unpopular Democratic President was voted out after one term largely due to high inflation.

Sound familiar?

Paul Volcker had just become Fed Chair and imposed historically tight monetary conditions, but he also had President Reagan’s support which enabled him to maintain the painful and unpopular policy. The Unemployment Rate actually peaked at a post-WWII high of 10.8% and Reagan's approval rating plunged early on. Critics at the time absolutely vilified and slandered Volcker for “destroying the US economy”. Farmers even drove their tractors to the Fed’s headquarters to protest. However, Volcker never backed down to short-term political pressure or took the easy way out. He just lit up another cigar and kept raising rates, causing even more short-term pain. He did this because he knew it was the right thing to do and that it would lead to long-term success for all Americans. He was of course, correct. Years later the politicians who slandered him publicly apologized and he is still today regarded as an American hero.

In the year 2025, it’s truly possible that Trump 2.0 is now acting as Volcker did in the early 1980’s. Jerome Powell might be the happiest man in America. Trump doesn’t need Powell to do the unpopular work because it seems he is willing to “Volcker” himself. It’s unimaginable in today’s climate that a politician would put (what they perceive as) long-term American goals above their own short-term political success, but it appears the Trump administration is indeed taking that risk.

The reality is that no one knows how this will work out in the end. Will the administration cave early under increased pressure from the public and collapsing approval ratings? Will they be walked back by falling markets? Will they overshoot their target and cause a massive recession? Or… will they achieve a growth slowdown and then an economic rebound with lower rates, low inflation and less government spending? We are certainly in for an interesting year ahead with a lot of volatility, but one thing is clear…

Volcker and Reagan proved that leaders can take actions that, though initially unpopular and even outright painful, better serve the nation’s longer-term interests.

As always, this is not financial advice. I am sharing my personal views. It is meant to stimulate ideas and is not to be considered investment advice. Please make your own decisions.