Many investors, including myself, would love the opportunity to invest in SpaceX but are unable to because it remains a private company. Well, it’s now possible to gain some SpaceX exposure due to an ETF offered by a largely unknown investment company in Boston. Let’s dive in…

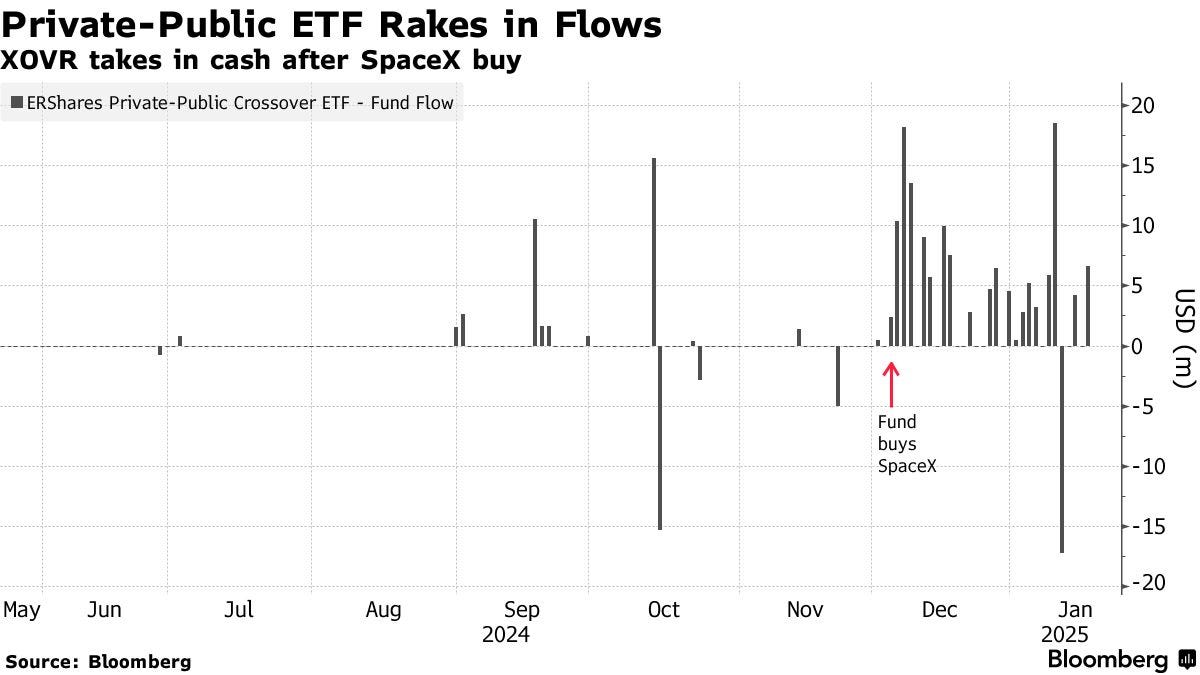

The ERShares Private-Public Crossover ETF XOVR 0.00%↑ recently purchased shares of the private rocket and satellite company in early December. Because of this move, the ETF has raked in more than $150 million over the last several weeks and brought it’s total assets up to ~$280 million. While large asset managers like BlackRock are working on giving public investors access to private markets through ETFs, $XOVR is currently the only US-listed ETF that holds SpaceX.

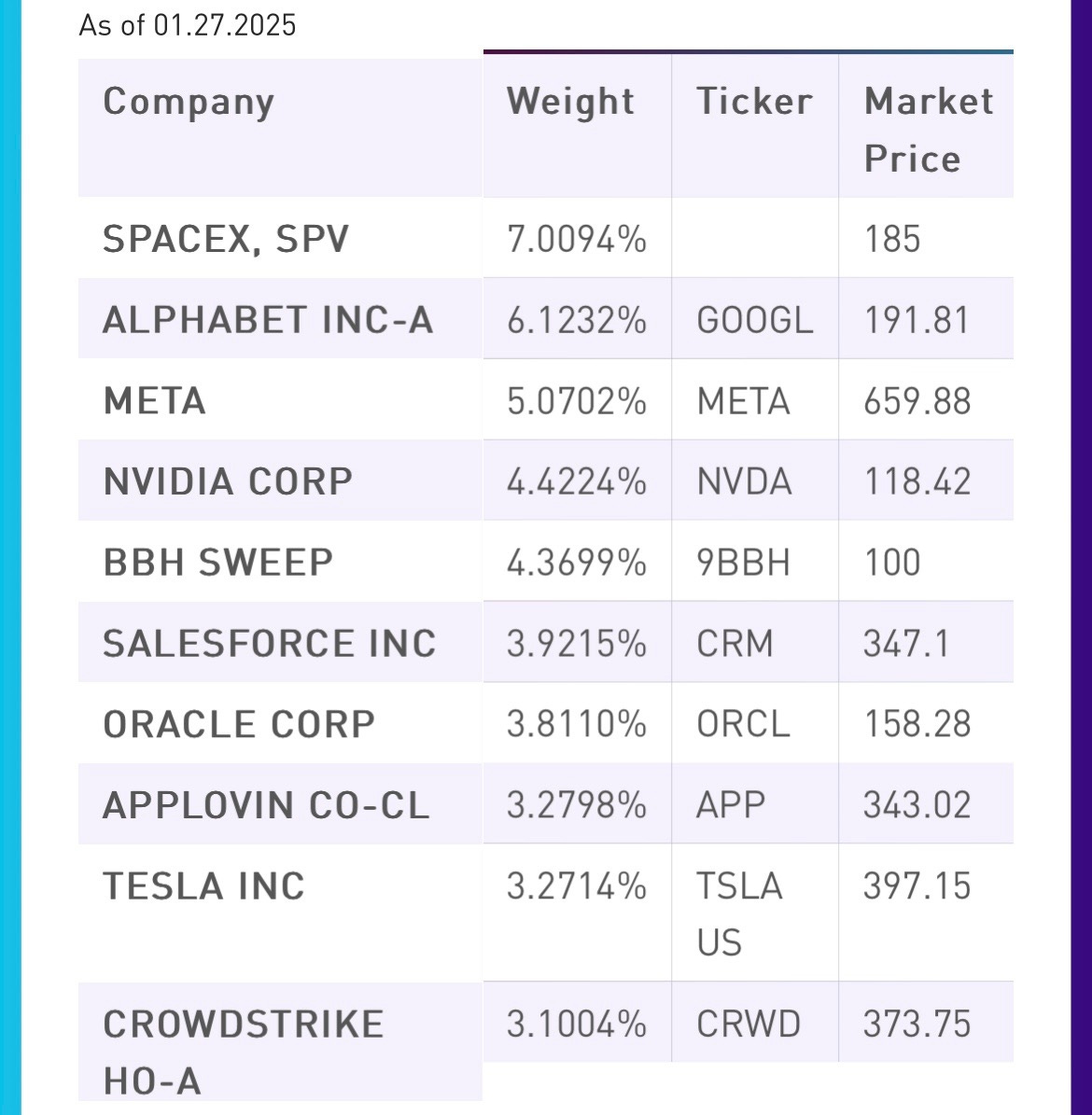

SpaceX is $XOVR’s first and only private holding, alongside their 30 other public companies that they consider “entrepreneurial companies”. SpaceX also happens to be the ETF’s top holding, with a 7%+ allocation. Here are the ETF’s top-10 holdings:

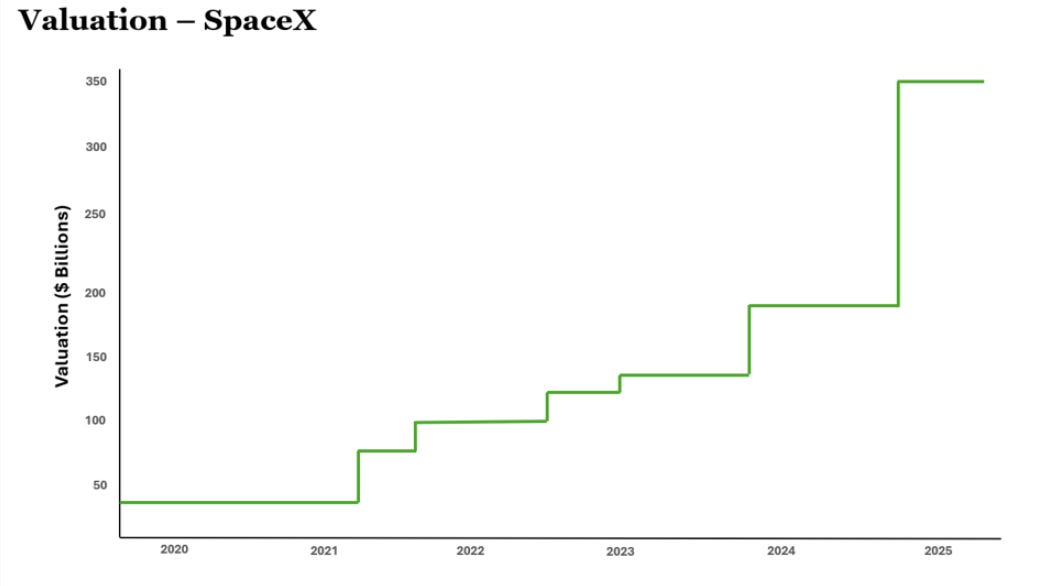

Just last month SpaceX was valued at $350 Billion, which already makes it the most valuable aerospace and defense company on the planet. While that may seem like an expensive price tag, almost everyone (myself included) expect that valuation to continue going nowhere but up. SpaceX is the clear leader in the space industry and the dominant launch provider globally. In terms of payload mass, SpaceX delivered an estimated ~90% of the total sent to space in 2024, largely due to its workhorse Falcon 9 rocket. Their reusable and reliable rockets have driven costs far below competitors, allowing the company to deploy thousands of LEO (Low-Earth Orbit) satellites. This vertical integration supports their own internet/communication business “Starlink”, which is also the leading product in it’s field and has increased it’s subscriber base by 100% annually in 2024. SpaceX is also the first private company to bring humans to the International Space Station, and are currently testing the ultra-heavy “Starship” rocket with the ultimate goal of reaching Mars. Because of their innovation, success and industry dominance they are now also a massive US defense contractor, securing revenues from both commercial and government sources.

One fair concern about trying to gain exposure to SpaceX through the $XOVR ETF, is the possibility of the position being diluted as the fund grows. XOVR’s 30 public stocks are rebalanced quarterly, and ERShares CEO Joel Shulman said they will add to and adjust their private holdings (SpaceX) whenever they feel the opportunity is right. However, Shulman recently reassured investors on their SpaceX position and suggested that they will continue adding to it:

“When you see a company like SpaceX, which has gone from $100 billion to $350 billion in just a couple of years, that’s a 300% appreciation that the public market has been shut out of… SpaceX is a long-term hold for us. We’re not going to change that at all, in fact we may add to it.”

I currently have no position in $XOVR but am looking at it closely. It’s a very interesting option, specifically if you like and want to hold the other top names in the ETF. I personally believe these next few years will be massive for SpaceX, especially now with Elon so close to the White House and President Trump very focused on space and the US Space Force. I don’t think it will be too long before SpaceX follows Tesla and becomes another Trillion dollar company in the Musk portfolio.

As always, this is not financial advice. I am sharing my personal views. It is meant to stimulate ideas and is not to be considered investment advice. Please make your own decisions.