Santa is Coming

We are rapidly closing in on the end of 2024. I wanted to do a quick overview of where things currently stand and how markets have historically performed into year-end. Lets dive in…

First, let's recap what markets have done this year.

The S&P 500 is just above 6,000 and up +28% YTD:

The Nasdaq is just under 20,000 and up +35% YTD:

Bitcoin is hovering around $100,000 and up +125% YTD:

Overall, it’s been another fantastic year for markets and specifically risk assets. Being fully invested was rewarded and the most popular names/segments led the way. Plus, even assets like Gold and other commodities have had great years, with Gold now up 31% YTD.

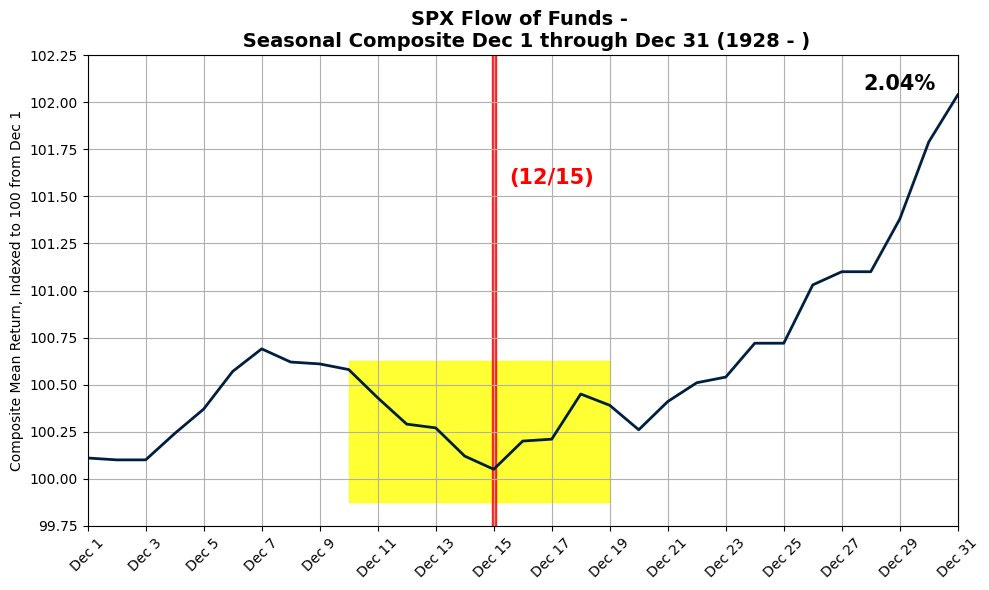

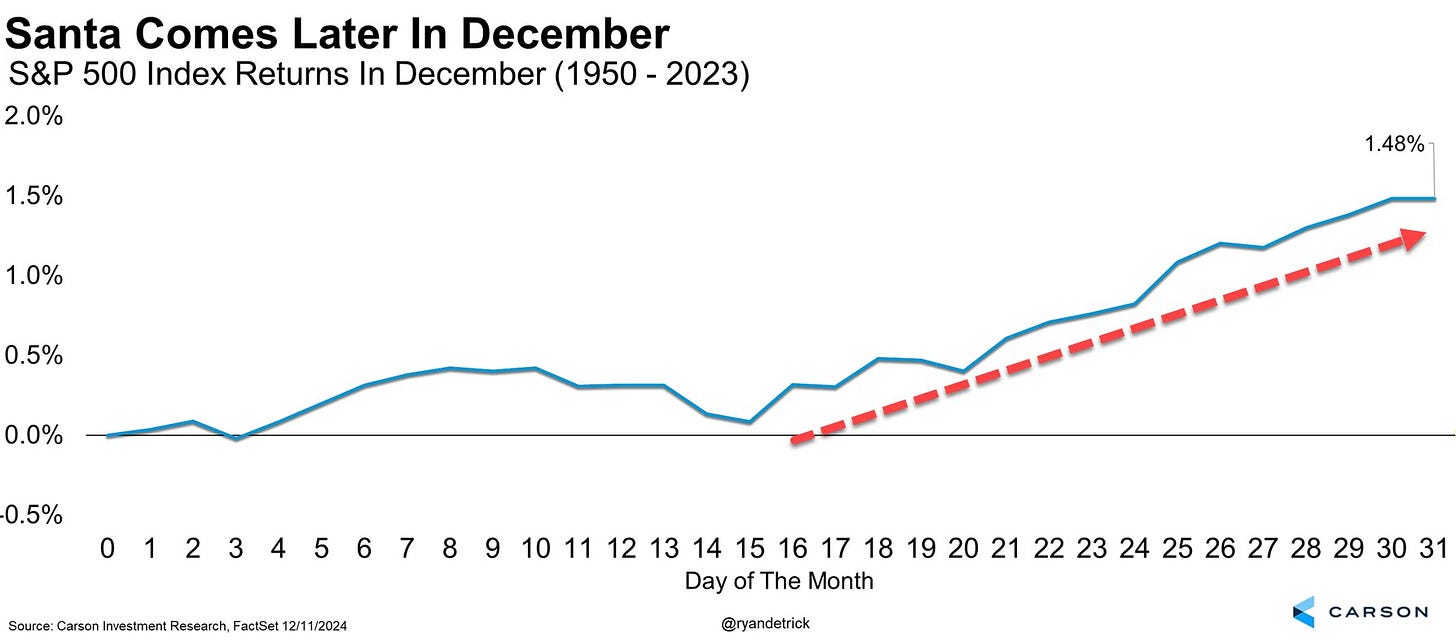

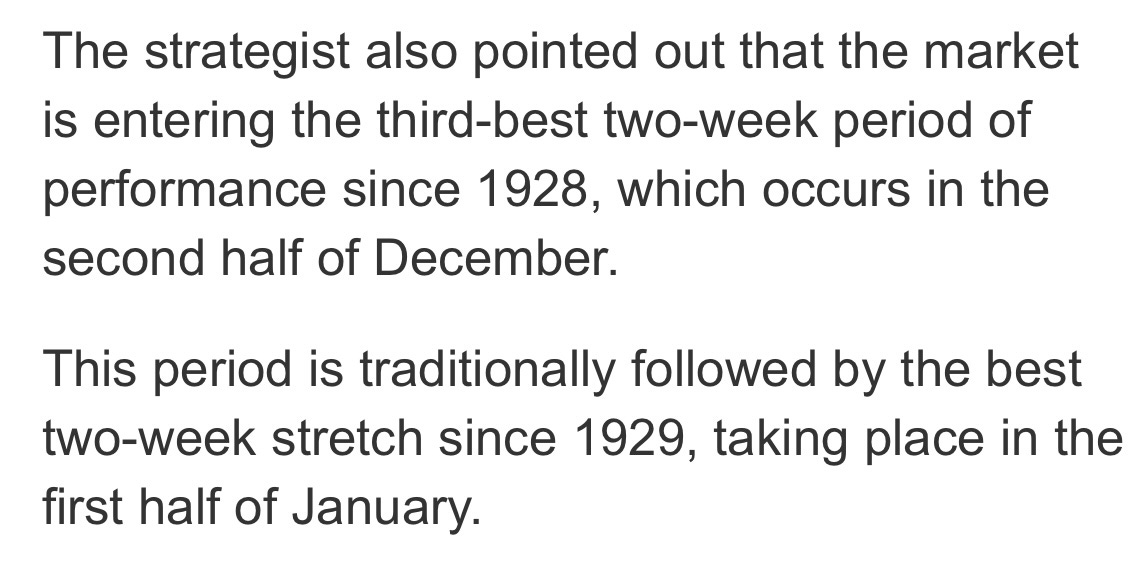

With only a couple of weeks left in 2024, let’s look at how we can expect things to wrap up. Historically, this is actually one of the best 2-week periods of the entire year based on seasonality over the last century. Take a look at the charts below which clearly show how strong average performance is in the second half of December. The last week specifically is commonly referred to as the “Santa Rally”.

SPX returns from 1928-2023:

SPX returns from 1950-2023:

Goldman's flow guru Scott Rubner also just put this out in his recent note: "The last two weeks of December and first two weeks of January are by far the best four-week period of the year with an average return of almost 3%."

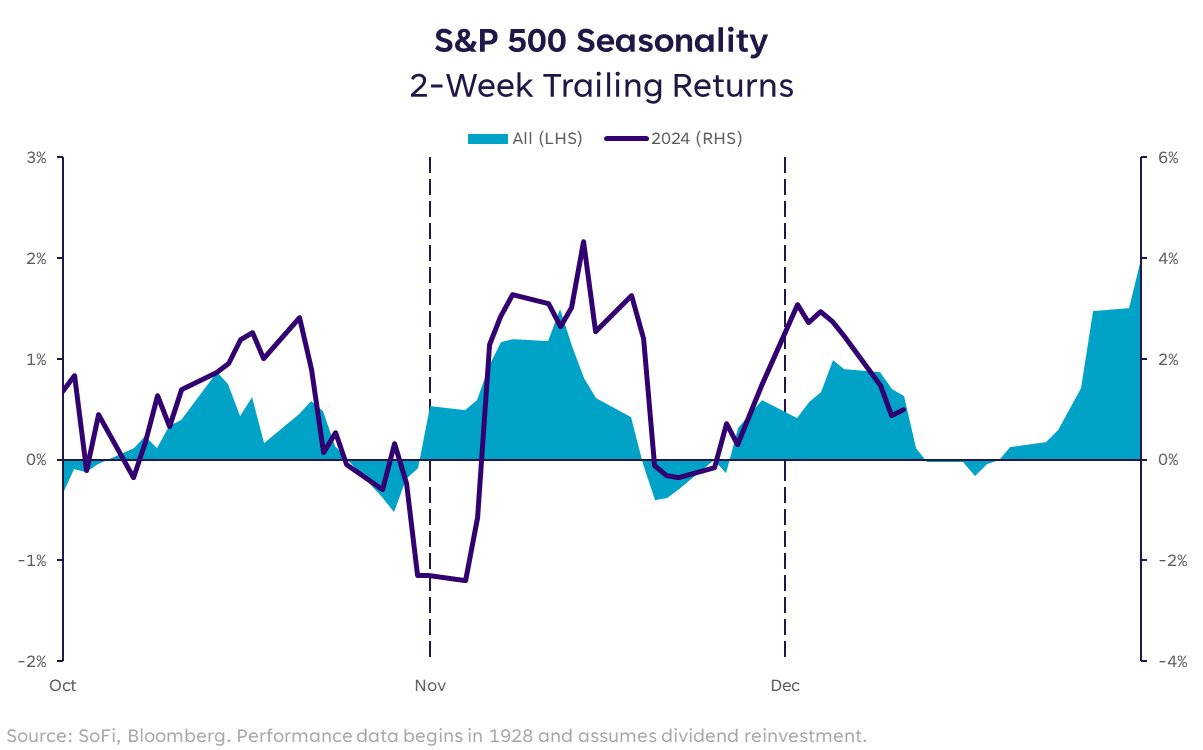

It’s important to note that seasonality and historic performance is not a perfect indicator. Markets can obviously move in completely unpredictable ways. However, in my experience certain periods of the year tend to be more reliable than others when it comes to trends. The back half of December is indeed one of those periods. If you are wondering how 2024 has tracked past seasonality so far, take a look at this chart of Q4:

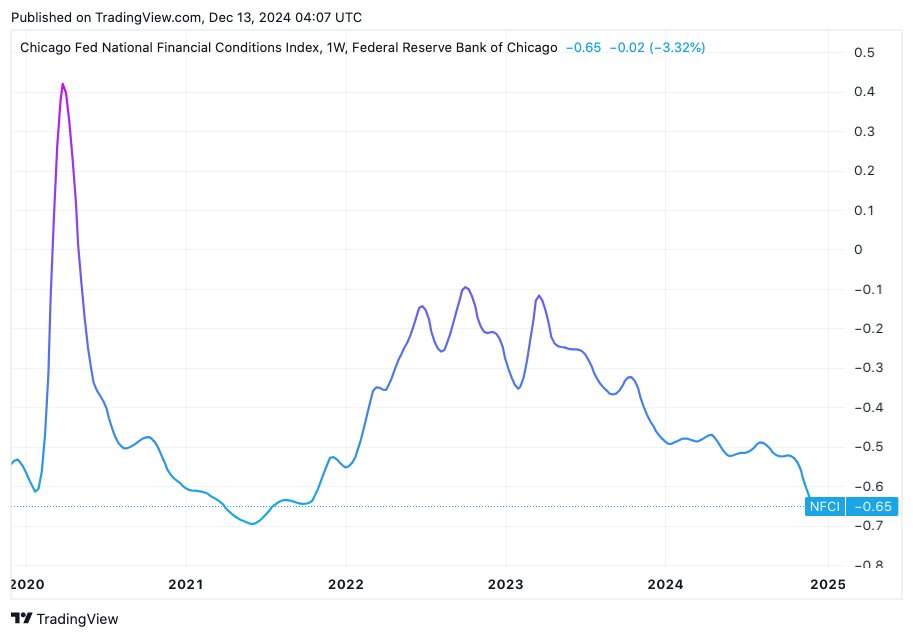

One big indicator you should definitely keep an eye on as we close out the year is the Chicago Fed Financial Conditions Index. Financial conditions are now almost as loose as they were during the 2021 peak mania bull market. These conditions can continue for a while or even loosen further, but it could also be a sign that we are approaching the end of a swing on the pendulum, and some tightening in the other direction could be coming.

To keep it short, after a massive year in markets and for risk assets, I am looking for a strong close into year-end. The Fed will be cutting another 25bps next week (even though inflation looks to be even stickier than expected), and very strong seasonality suggests that investors will get a Santa Rally. I will have another post up soon on what I’m expecting for markets in 2025, and some individual stocks on my radar.

PS - Trump ringing the bell at the NYSE and being interviewd by Jim Cramer did make me a little nervous.

DISCLAIMER:

This is not financial advice. For entertainment purposes only. Make your own decisions. These are my personal opinions. I am not responsible for any losses.